The Best MetaTrader 5 Indicators for 2023

Contents:

They would not gain the abilities to evaluate patterns and make choices on their own if they always had to rely on signals. Checking out a lot of books on technical analysis helps to narrow the list down. You quickly no Macd Trading signals in on the handful that keep showing up again and once again in book after book. General uptrend and general downtrend-Before investing or Macd Trading this is the most essential indication.

Market scanning can be done pretty casually with the help of these Forex indicators. Signals and the indications would be given as per the market situation to help you with the exact trading and the investments. Okay, before you even start using these Forex indicators, you actually need to know that these indicators have got plenty of benefits. When it comes to the indicators, you will find many of these indicators for sure. You can merely avail for more and more information about the Forex indicators below.

Bollinger bands Indicator

The ease of movement value gauges the strength of the market momentum. If the ROC indicator starts moving up or down from the zero level, one could consider entering a trade. The above screenshot displays four signals to enter a sell trade.

10 Best Forex Strategies for March 2023 Explained – Business 2 Community

10 Best Forex Strategies for March 2023 Explained.

Posted: Wed, 09 Nov 2022 08:00:00 GMT [source]

This tool enables the traders to identify how far the price may go before a pullback finish. The extension levels are periods where the chances are that the price may reverse. To short it down, by subtracting the 26-period exponential moving average from the 12-period EMA, moving average convergence divergence is determined. It is unbounded and appears below the price action in most cases.

Best Volume Indicator For Forex (2023 Update)

The first type is based on the channel breakout and the beginner of the trend. The second one suggests the price return to the center of the channel after the rebound from the channel borders. Close is the closing price of the current candlestick, the SMA is a simple moving average for a period specified in the settings. Both oscillators are used only in conjunction with trend indicators. The SMA is a simple moving average, N is the calculation period, U and D are values obtained by comparing the prices of the current and the previous candlesticks.

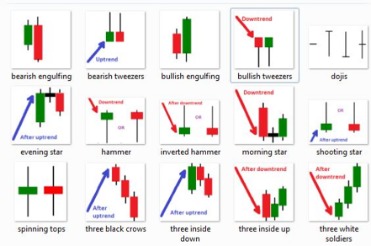

Captain America Forex Indicator is a trend-following tool and works on crossover signaling methods. If you do trading within these sessions then you will get very good accuracy and forex indicators work very well within this session. We have created verygood indicatorsthat works very well in these sessions. Movement in the forex market happens only during the session and forex news also comes within the session itself. Here are some examples of how you can use the Exponential Moving Average indicator combined with simple candlestick patterns to create a profitable forex trading strategy.

Forex Momentum Indicators

MA – moving average for a period n, specified in the settings. The increase in the Standard Deviation confirms the uptrend. When the volatility declines, there appears the consolidation zone, which should be followed by an uptrend, accompanied by the rise of the SD value. The BBW is good as an additional tool, suitable for traders of any skill level who work with channel strategies.

These https://g-markets.net/ can build important levels, which are not visible in the chart. The economy develops according to the wave theory; there is a top and a bottom, there is an increase and a decline. Cycles could have different lengths, but the fundamental factors of each of the cycle stages allow predicting the future price trends. The difference between technical and fundamental analysis is in the principles and approach to forecasting.

That’s why it is necessary to include extra filters such as higher timeframe structure in order to increase its accuracy. Using this method is fantastic for capturing high-momentum and trending markets as you are guaranteed to stay in the trade until the trend reverses . Its main purpose is to measure volatility in the markets. By learning to interpret the ATR reading you can learn how to objectively determine market volatility in a practical manner. People from various countries can make use of these indicators and the signals investing in various currencies.

Bollinger Bands is a channel indicator combining the features of the oscillator and a volatility tool. The indicator is composed of three simple moving averages, the distance of which is measured according to the standard deviation formula. This is one of the examples of a profitable forex strategy. In the daily chart, the EOM line is smoothed, moving along with the zero line.

best forex indicators to use should be used for confirmation rather than identification. You will be able to comprehend how to apply the indicator to improve your trading skills in this manner. Choose the best forex indicator for better effectiveness and experience. If you want to trade Forex like a pro, you’ll need Forex Indicators. Before choosing a forex indicator as a novice, make sure you know how it works by practicing with a demo account.

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-vQW4Fia8IM73qAYt.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

It is clear that the indicator is quite accurately following the trend. Unlike common oscillators, this tool is difficult to interpret, according to the overbought/oversold zones. So, I recommend studying the detailedguide to understand the signals search and interpretation. It is applied to identify the trend and build support and resistance levels.

The SAR acronym stands for ‘stop and reverse.’ Essentially, the indicator will trail price as the trend moves over time. It does this by drawing a small dot above price in a downtrend and below the price in an uptrend. The Williams %R indicator can be used as an overbought and oversold indicator as well as a divergence indicator as well.

Best Forex Indicators: 5 Indicators to Understand the Market … – Benzinga

Best Forex Indicators: 5 Indicators to Understand the Market ….

Posted: Sun, 20 Sep 2020 16:01:09 GMT [source]

The possible retracement levels have been marked at 38.2% and 61.8%. The key levels to look out for are 38.2% and 61.8%, respectively. The 50% level is not technically a Fibonacci level but is considered a necessary threshold. While using the Swing Sequence for Forex trading, you should be careful to follow one trading style as a trader. Since this trading style needs holding positions, switching trading styles is not recommended.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

The MACD indicator is used to identify trend reversals, momentum shifts, and potential entry and exit points in the market. When the MACD line crosses above the signal line, it is a bullish signal, indicating that the price may rise. Conversely, when the MACD line crosses below the signal line, it is a bearish signal, indicating that the price may fall. Once you are doing price action trading, there’s no need for any indicators or utilizing trend lines and a moving average.

The vortex indicator plots two oscillating lines, one to identify an uptrend (VI+) and the other is to identify a downtrend (VI-). It can be recommended to beginner traders mastering new professional tools. It also will be of interest to scalpers and swing traders. One of the ADX signals is when its two additional lines meet. In the first case, the blue DI+ crosses the red DI- to the upside, it signals an uptrend. In the second case, the blue line crosses the red one to the downside.

This indicator measures the trend strength and direction. It signals trading flat, sends rare but accurate signals. Swing trading is a short-term strategy based on the idea to put an order in the trend direction at the end of the correction. MACD, RSI, CCI, and stochastic are utilized in combination with trend indicators to get stronger signals. It sends more accurate signals in the timeframes of М15-М30, where there is less market noise, and price swings are not that sharp.

Leave a comment